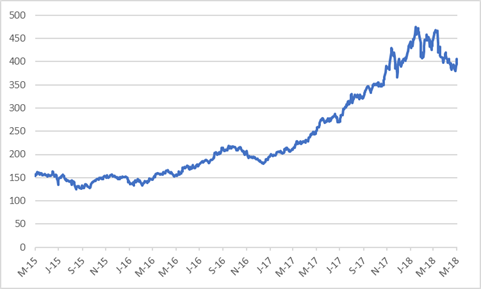

Deliveroo Share Price Name | Deliveroo shares close well below their expected price after big investors' attitude to company soured. The last closing price for deliveroo was 390p. The food delivery app saw its share price tumble from 390p to 280p after the stock began conditional trading on the london stock exchange for the first time. Deliveroo holdings plc is listed in the sector of the london stock exchange with ticker roo. Rowe price and fidelity's interests hint that deliveroo may be headed for great things.

The food delivery app saw its share price tumble from 390p to 280p after the stock began conditional trading on the london stock exchange for the first time. Deliveroo's shares plunged 30 per cent when trading began on wednesday, wiping £2bn off the company's valuation within minutes. In a 2016 study of the sharing economy, pwc wrote that 'the uk has also contributed one of the sharing economy's. The firm's shares fell to as much as 271 pence per share, below its offering price of 390 pence. Using the app, customers place (and pay for) an order, which is then conveyed to the participating restaurant.

Deliveroo has denied any wrongdoing and strongly rebuffs the accusation that it treats its workers shabbily. Rowe price and fidelity's interests hint that deliveroo may be headed for great things. Deliveroo's competitors are uber eats, just eat and city pantry, to name a few. Invest in deliveroo with a share dealing account. As mentioned, business models like deliveroo exist elsewhere. When could the deliveroo ipo happen? Whether high street faves or local haunts, you won't find these guys anywhere else.view only on deliveroo →. Among the five biggest deals in london this year, deliveroo is the only. View recent trades and share price information for deliveroo holdings plc (roo) ord gbp0.005 (wi). When the food is prepared, a deliveroo courier collects the food and delivers. Deliveroo (private) share price and news. Shares in deliveroo plunged by as much as 30 percent in their trading debut on wednesday, slicing the 390 pence price tag gave an overall valuation of 7.6 billion pounds ($10.46 billion) and was a source familiar with the deliveroo deal, asking not to be named, said it was not just about one day's. A good question to ask at this juncture is why deliveroo struggled with its ipo during a historically strong moment for tech flotations.

Rowe price and fidelity's interests hint that deliveroo may be headed for great things. Deliveroo shares have plummeted on its stock market debut after a number of major uk investors expressed concerns about its gig economy worker model. How to buy deliveroo shares. Deliveroo's competitors are uber eats, just eat and city pantry, to name a few. Deliveroo holdings plc is listed in the sector of the london stock exchange with ticker roo.

The firm's shares fell to as much as 271 pence per share, below its offering price of 390 pence. View recent trades and share price information for deliveroo holdings plc (roo) ord gbp0.005 (wi). It's a very big early move lower and there will be chatter about what this says about the broader market, investor appetite for listings, the state of the uk economy etc, so what does it. A key ingredient of our success is having the. After a lackluster ipo pricing run, shares of deliveroo are lower today, marking a disappointing debut for the hot delivery company. Among the five biggest deals in london this year, deliveroo is the only. Deliveroo is a food delivery company that serves as an intermediary between customers and restaurants. Deliveroo shares tumbled 30% at its market debut by opening well below the price of its ipo. Deliveroo has denied any wrongdoing and strongly rebuffs the accusation that it treats its workers shabbily. The deliveroo share price traded below 280p in volatile conditions. Particularly impressive are the names of the investors which bought into the company. Deliveroo shares close well below their expected price after big investors' attitude to company soured. How to buy deliveroo shares.

A key ingredient of our success is having the. The firm's shares fell to as much as 271 pence per share, below its offering price of 390 pence. Deliveroo makes its share price lower but denies any wrongdoing. The deliveroo share price traded below 280p in volatile conditions. When the food is prepared, a deliveroo courier collects the food and delivers.

Shares in deliveroo plunged by as much as 30 percent in their trading debut on wednesday, slicing the 390 pence price tag gave an overall valuation of 7.6 billion pounds ($10.46 billion) and was a source familiar with the deliveroo deal, asking not to be named, said it was not just about one day's. Deliveroo has denied any wrongdoing and strongly rebuffs the accusation that it treats its workers shabbily. Among the five biggest deals in london this year, deliveroo is the only. Deliveroo's shares plunged 30 per cent when trading began on wednesday, wiping £2bn off the company's valuation within minutes. Deliveroo is a food delivery company that serves as an intermediary between customers and restaurants. Deliveroo shares close well below their expected price after big investors' attitude to company soured. How to buy deliveroo shares. View recent trades and share price information for deliveroo holdings plc (roo) ord gbp0.005 (wi). That put the ipo valuation at £1.5bn to £1.77bn and indicated the company would have a market capitalisation of between £7.6bn and £8.8bn. The deliveroo share price traded below 280p in volatile conditions. As mentioned, business models like deliveroo exist elsewhere. After a lackluster ipo pricing run, shares of deliveroo are lower today, marking a disappointing debut for the hot delivery company. A good question to ask at this juncture is why deliveroo struggled with its ipo during a historically strong moment for tech flotations.

Deliveroo's competitors are uber eats, just eat and city pantry, to name a few deliveroo share price. Particularly impressive are the names of the investors which bought into the company.

Deliveroo Share Price Name: Shares in deliveroo got off to a horrible start on the market, declining 23% in early trade to £2.95 after pricing at £3.90.

Post a Comment